Partnering with Aegis Specialty Dealer Division.

About Aegis Specialty Dealer Division

When you partner with Managing General Agency Aegis Specialty Dealer Division, you immediately get what makes us and our program so different. We understand the Garage and Dealers market. We know what it takes to properly protect this industry’s risks and we know how to ensure our program is profitable and has legs for years to come.

During the last few years, we saw industry players exit the space, make changes to coverage availability and terms, and increase rates significantly as the niche became unprofitable for some. Insurance agents scrambled to get insureds the coverages they need. This was an opportunity for us to step in and provide a robust product, having been tremendously successful in developing and distributing profitable programs in other industry niches.

We are part of K2 Insurance Services, LLC, a leading underwriting and distribution franchise in the program insurance market. The K2 Insurance family of MGAs has more than 20 operating companies and more than $1 billion in annual written premium. With their support, we developed an exclusive broad product that agents and their Garage and Dealer customers expect. We also implemented strong underwriting practices to ensure our commitment in the program every year.

Our Garage & Dealer Specialist Behind the Wheel

Aegis Specialty Dealer Division is led by Daniel Marzouk, an experienced executive in the garage and dealer insurance space; who has built a profitable and successful book of business. With more than 20 years of insurance experience, Daniel has spearheaded new programs, with a focus on customer and agent experience. Daniel’s data-driven insights contribute to the design and execution of products that assist agents in better servicing their clients. His expansive expertise in policy development allows his carrier partners to provide robust coverage offerings.

Our Platform Facilities Submissions, Renewals & Claims

Our operational platform includes a policy administration system with seamless integration into our rating and underwriting operating systems. This allows for our team to respond quickly to underwriting requests. Our applications are available via PDF, Word and even as a link you can start filling out and forward to a customer to easily fill out on their cell phone, tablet or desktop. Don’t worry our applications can be E-signed which can be easily returned. No more chasing paperwork. Our accounting integration allows your team easy access to obtain any invoices we issue and they can easily pay online.

In addition, collecting external data to assist in our underwriting for each account is our priority. With integrated tools such as weather scoring, MVR monitoring, loss-control integration, we have developed a best-in-class strategy to maximize results.

Our Servicing

Our third-party administrator is focused on providing exceptional customer service, mitigating loss expenses, and providing state-of-the-art technology. With more than 400 employees, and a network of over 5,000 contracted independent adjusters, our entire team is here to help you.

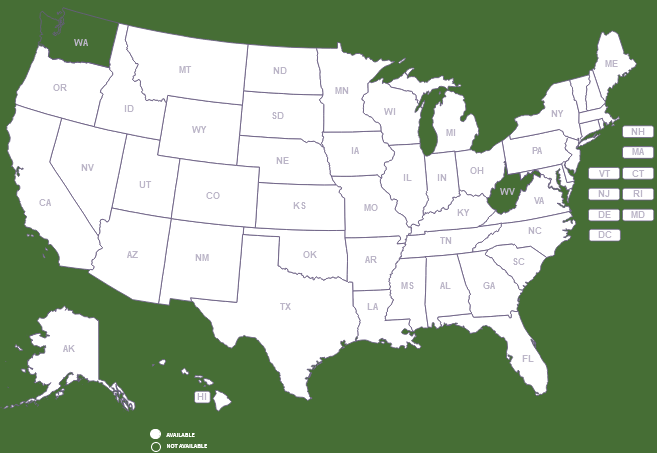

See What’s Available In Your State

Not Available